Around The Herd | Recorded Live 4.6.2023

Welcome to Around The Herd with Bison Venture Partners where we’re educating 10,000 new Angel Investors over the next decade in our mission to build generational wealth with our community. Why? Because investing in privately-held businesses has historically been a proven wealth-building strategy for elites, but the rules have changed, and it’s never been easier for everyday people to do the same. If we’re going to close the racial & wealth gaps that exist today, we must leverage innovative opportunities to do so. Be sure to subscribe to our newsletter and podcast at www.bv.partners and follow us @bisonvp on social media to stay up to date and be in-the-know about other exciting opportunities.

Today, we’re discussing an equity crowdfunding investment opportunity in Substack, which is currently fundraising on Wefunder! Before we get into that, here’s a quick message from our sponsor, BVP Coffee Co.

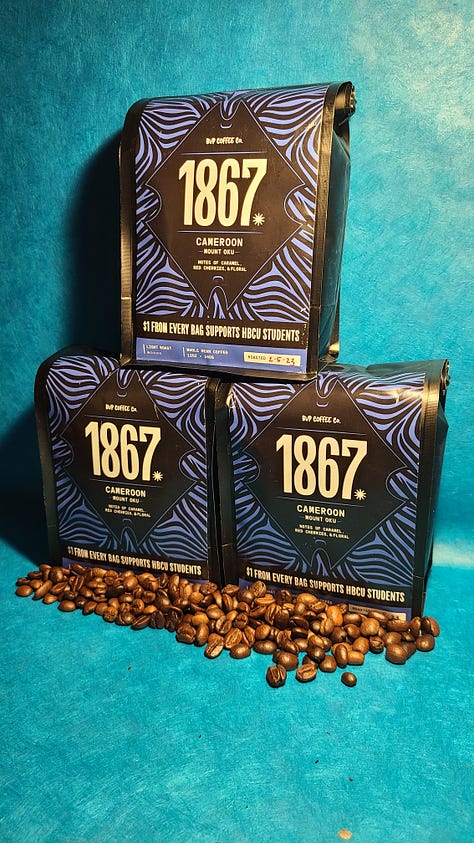

Sponsored by BVP Coffee Co.

BVP Coffee Co. provides single origin coffee and unique blends from all around the world. We bring communities together through stories of global travel, entrepreneurship, and collaboration. Our latest product, “1867,” is an ode to the rich & illustrious legacies of two of the world’s leading educational institutions, Howard University & Morehouse College—both established in the year 1867. Each bag celebrates the collaboration of servant leaders devoted to uplifting their communities through entrepreneurship. In our mission to invest in the next generation, we donate $1 from each bag sold to support business students attending Historically Black Colleges & Universities. Visit www.bvp.coffee and help us raise $1M in scholarships for HBCU entrepreneurs. Be sure to use our discount code “BVPHERD” for free shipping!

Disclaimer

Please read this investment disclaimer carefully before considering any investment discussed in this newsletter or any other material provided by Bison Venture Partners.

The information and opinions presented in this newsletter are for educational and informational purposes only and should not be construed as investment advice, an offer to sell, or a solicitation of an offer to buy any securities or financial products. The opinions expressed in this newsletter are those of the authors and do not necessarily represent the opinions of Bison Venture Partners.

Investing in securities, including private companies and crowdfunding opportunities, involves significant risks, including the potential loss of the entire investment amount. Investments should only be made by investors who are financially able and willing to bear these risks. The information provided in this newsletter is not intended to be a comprehensive analysis of any investment opportunity, and investors should conduct their own due diligence before making any investment decisions.

Past performance is not indicative of future results, and there can be no assurance that any investment will achieve its objectives or that any projections, estimates, or forward-looking statements will be realized. The value of investments can go down as well as up, and investors may not get back the full amount invested.

Bison Venture Partners is not a registered investment advisor, broker-dealer, or crowdfunding portal. We do not provide personalized investment advice, and we are not responsible for the investment decisions made by our readers or subscribers. It is the responsibility of each individual investor to consider their investment objectives, risk tolerance, and financial situation before making any investment decision.

Any investment mentioned in this newsletter may not be suitable for all investors, and we strongly encourage you to consult with a professional financial advisor, attorney, or tax advisor before making any investment decision. By accessing the information provided in this newsletter or any other material provided by Bison Venture Partners, you agree to be bound by the terms and conditions set forth in this investment disclaimer and release Bison Venture Partners, its affiliates, and their respective directors, officers, employees, and agents from any and all liability arising from your use of this newsletter and any investment decisions you make based on the information provided.

Investment Memo | Substack on Wefunder

Substack is an online platform that allows writers and creators to publish and monetize their content through paid email newsletters. It was founded in 2017 by Chris Best, Jairaj Sethi, and Hamish McKenzie. The platform enables writers to build their audience, distribute their work, and generate income from subscriptions.

Substack is popular among journalists, bloggers, and subject matter experts who want to create an independent income stream without relying on traditional media outlets, advertising, or sponsored content. The platform handles various aspects of content creation, such as hosting, email delivery, and payment processing, allowing writers to focus on creating high-quality content for their subscribers.

Substack's model allows creators to offer both free and paid content, making it accessible to a broader audience. Free content helps attract new subscribers, while premium content is reserved for paying subscribers. The platform has gained significant traction over the past few years, attracting well-known writers and journalists and a growing number of subscribers.

Campaign Highlights

Substack is on a mission to create a new economic engine for culture by offering a subscription network that supports various forms of content creation, including writing, podcasting, and community building. Boasting over 35 million active subscriptions, with 2 million of them being paid, Substack is a significant player in the content subscription space. The platform is responsible for 40% of all subscriptions and 15% of paid subscriptions on its network. To date, readers have contributed more than $300 million to writers through Substack, showcasing its impact on the content creator ecosystem.

Key Details

Product

Substack's product offering revolves around enabling creators to build and monetize their audience through newsletters. The platform provides hosting, email delivery, and payment processing services, allowing writers to focus on creating high-quality content. Substack's user-friendly interface has attracted a diverse range of content creators, from journalists and bloggers to subject matter experts.

Market

The global market for newsletters and content creators has been growing steadily, fueled by the increasing demand for quality content and a shift toward independent journalism. Substack's target market includes both content creators and consumers who are willing to pay for premium content. With a growing number of internet users worldwide and the ongoing trend of direct-to-consumer content consumption, Substack is well-positioned to capitalize on this expanding market.

According to a report by Grand View Research, the global subscription market is expected to reach $246.6 billion by 2025, growing at a CAGR of 18.2%. This presents a significant opportunity for platforms like Substack, as more people are willing to pay for high-quality, niche content.

Business Model & Traction

Since its founding in 2017, Substack has garnered significant traction, attracting high-profile writers and journalists while amassing a large and growing user base. The platform's quick adoption and success in raising funds on Wefunder are indicative of its popularity and potential for continued growth.

Substack operates on a revenue-sharing model, taking a 10% fee from creator earnings. In return, they provide a comprehensive platform for content creators to monetize their work through subscriptions. Substack's network now drives 40% of all subscriptions and 15% of paid subscriptions on the platform. Cumulatively, readers have paid writers over $300 million through Substack.

The platform has been successful in attracting high-profile writers and journalists, such as Glenn Greenwald and Anne Helen Petersen. It has also expanded to podcasts, with popular shows like The All-In Podcast and The Prof G Show.

Substack's growth has been impressive. In 2020, the company reportedly had a 10x YoY increase in paid subscribers and a 60x YoY increase in revenue. The platform now boasts over 500,000 paid subscribers, and their top 10 writers are estimated to earn over $20 million collectively.

Team

Substack's founding team comprises Chris Best, Jairaj Sethi, and Hamish McKenzie. With a strong background in technology and journalism, the team has the necessary expertise to drive Substack's growth and development.

Financials and Valuation

The current fundraising round values Substack at a pre-money valuation of $585 million. With the company's impressive growth and market opportunity, investors may see potential for a strong ROI. However, it's essential to consider the risks associated with investing in a high-growth, early-stage company.

To assess the potential for ROI, investors should examine the company's financial performance, market share, and competitive landscape. For instance, comparing Substack's valuation and financials to other content subscription platforms like Patreon, valued at $4 billion in its latest funding round, may provide insight into Substack's potential growth trajectory and returns.

Risks

As with any investment, there are inherent risks involved. Substack faces competition from other content platforms and traditional media outlets. Additionally, changes in regulations or user behavior could impact the company's growth trajectory. However, Substack's strong traction and user growth indicate that it is well-equipped to navigate these challenges.

Questions to Consider Before Investing

Before considering an investment in Substack, potential investors should ask themselves the following questions for each section of the memo:

Market Opportunity:

Do I believe that the subscription-based content market will continue to grow and thrive in the future?

How does Substack differentiate itself from other platforms in this market, and do I see that as a sustainable advantage?

Is there enough room for multiple players in the content subscription space, or will a single dominant platform emerge?

Business Model and Traction:

How does Substack's revenue sharing model with creators affect its long-term profitability and scalability?

Do I believe that Substack's current traction, with 35 million active subscriptions and $300 million paid to writers, indicates a strong potential for continued growth?

How will Substack continue to attract new creators and subscribers to maintain its growth trajectory?

Financials and Valuation:

Given Substack's $585 million pre-money valuation and its financial performance, do I believe the company is fairly valued?

Considering the risks and potential rewards, am I comfortable investing in Substack at this valuation?

How does Substack's financial performance and growth compare to other companies in the content subscription space, and does that justify the valuation?

By reflecting on these questions, investors can better assess the suitability of an investment in Substack and ensure it aligns with their investment goals and risk tolerance.

Key Definitions

Pre-money valuation: This is the estimated value of a company before it receives external funding from investors. It represents the company's worth based on its historical performance, growth potential, and other factors. Pre-money valuation helps determine the price per share for new investors, as well as how much equity the founders and existing shareholders will retain after the investment.

Post-money valuation: This is the estimated value of a company after it has received external funding from investors. It is calculated by adding the amount of investment raised to the pre-money valuation. Post-money valuation helps investors understand their ownership percentage in the company, as it represents the total value of the company, including the new investment. For example, if a company has a pre-money valuation of $5 million and raises $1 million in funding, its post-money valuation would be $6 million ($5 million pre-money + $1 million investment).

ROI (Return on Investment): ROI is a financial metric used to evaluate the performance of an investment. It measures the profit or loss generated by an investment relative to the amount of money initially invested. ROI is typically expressed as a percentage and is calculated by dividing the net profit (or loss) by the initial investment amount. For example, if you invested $10,000 in a company and later sold your shares for $15,000, your ROI would be 50% (($15,000 - $10,000) / $10,000).

CAGR (Compound Annual Growth Rate): CAGR is a financial metric used to measure the average annual growth rate of an investment over a specific period. It represents the consistent rate at which an investment would have grown if its value had increased at the same rate every year. CAGR is calculated using the initial and final values of the investment, as well as the number of years the investment was held. For example, if an investment grew from $5,000 to $10,000 over five years, the CAGR would be 14.87% ([(10,000 / 5,000)^(1/5) - 1]).

Conclusion

Substack's compelling product offering, growing market, impressive traction, and experienced team make it a promising investment opportunity. By participating in this crowdfunding round, community members can support the platform we use and love while potentially benefiting from Substack's continued growth.

If you enjoyed our review of this investment opportunity, don’t forget to subscribe to our newsletter and follow us on all socials @bisonvp (Instagram, Twitter, LinkedIn). We’ll see you next week Around The Herd.