Hi everyone,

I’m excited to share that we’ve extended the close date of our Community Round! This means that we’ll continue to fundraise and accept new investments through October.

Last week, I had the privilege of presenting Bison Venture Partners at my alma mater, University of Delaware, where I completed my first pre-accelerator just 4 years ago. Check out the pitch above to learn more about Bison Venture Partners, our business model, and how we plan on generating a return for investors.

As a reminder, our minimum investment amount is just $100, and anyone can become an angel investor in our growing enterprise. Visit wefunder.com/bisonvp to Join The Herd and lock in your investment today!

See below for the full video transcript & pitch deck…

“Good afternoon everyone. My name is Garry, I'm the Founder & CEO of a new company called Bison Venture Partners. We're built on the principle that if you want to go fast, you go alone, but if you want to go far, you go together. Today, I'm going to be sharing more about our company and our current community round where anybody can become an Angel Investor, for as little as $100.

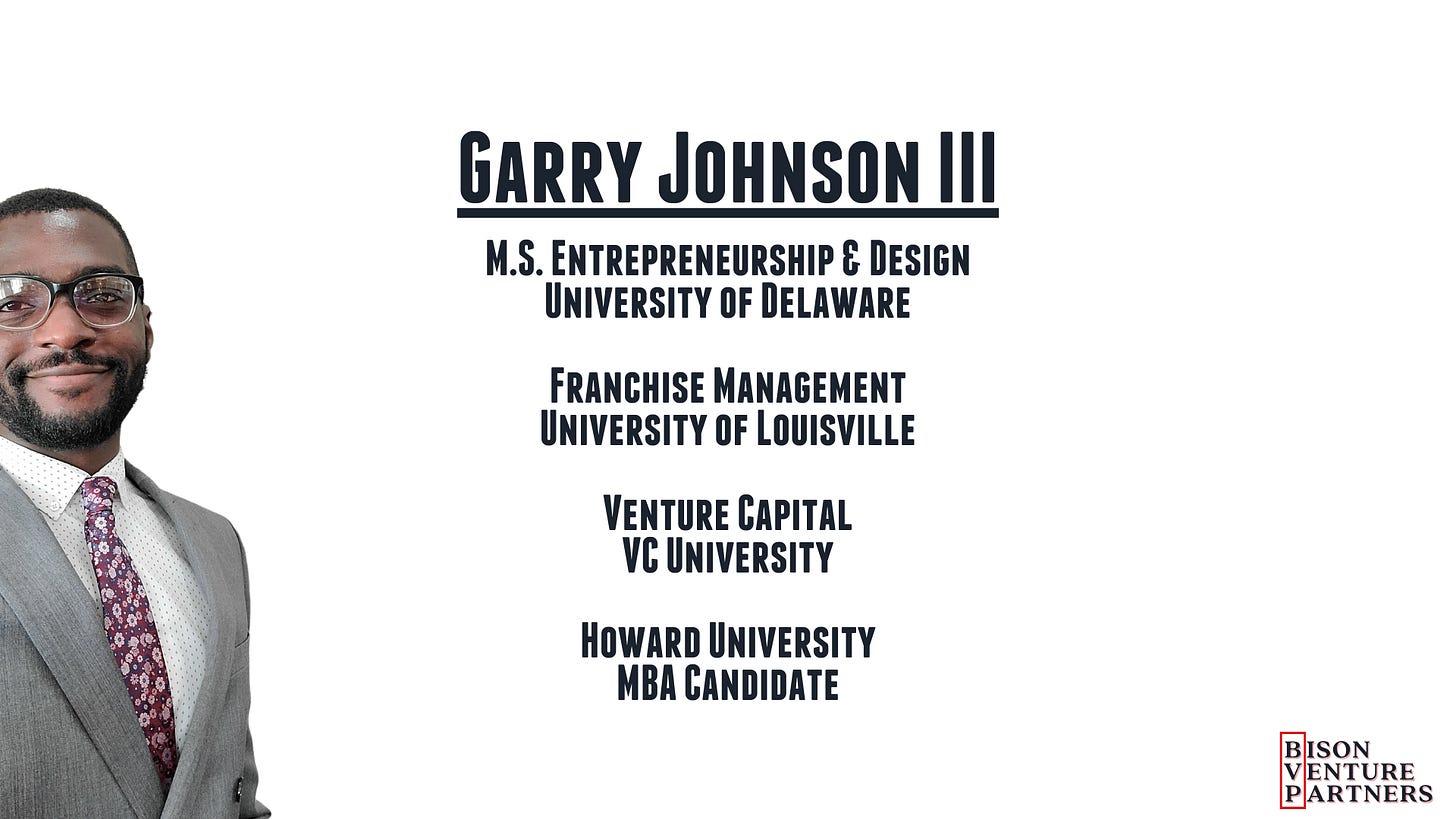

I'm gonna give you a little background on me.... The journey started right here at Horn Entrepreneurship at UD. I received my Bachelor's here and then a Master's in Entrepreneurship & Design in 2018. And since then, I've received a certificate in Franchise Management from the UofL, a certificate in Venture Capital from VC University, and I'm currently getting my MBA at the illustrious Howard University in Washington, DC.

Now, back in 2018, I was on a much smaller stage, but I was finishing Summer Founders myself in the Venture Development Center. And what I was presenting was the opportunity to build a more equitable and inclusive startup ecosystem. The opportunity that I identified was that there are amazing entrepreneurs in our communities. But not everyone has the opportunity and an access to resources to build a successful startup, so I wanted to do something about it. So since launching the first time is accelerated right here in New Castle County, Delaware, and supported a small cohort of entrepreneurs that was eight founders based in Wilmington. With the help of New Castle County, Delaware and Delaware Prosperity Partnership, we've since grown to becoming a 501(c)(3) organization supporting a global community of over 300 early stage underrepresented entrepreneurs, and its helped them raise over $500,000 in non dilutive capital. So we take a lot of pride in that work. And it wouldn't be possible without partnering and collaborating with amazing companies such as Microsoft, Google, Procter and Gamble, IBM, and many more.

Now, the reality is, the problem is so big that just one entity, one nonprofit, can't solve it alone. So when I went back to school, I'm sitting around talking to my classmates, and we're doing more research about how big this problem actually is. And Morgan Stanley and McKinsey tell us that investors report capitalizing multicultural businesses at 80% less than businesses overall, and that his lack of access to capital and investing in these founders would contribute to $4.4 trillion to our community. So, we see this as an opportunity to one to do good while also making money. And if we are able to build a more equitable economy that benefits multicultural founders, we will build an economy that is dynamic and resilient and benefits us all.

So my classmates got together and we decided, you know what, we're gonna do something about this problem. So we designed a framework that revolves around creating, scaling and investing in a more equitable future. We want to create new businesses, high quality jobs, and ownership opportunities for everyday people. We want to scale those businesses through access to capital, technology adoption, and strategic partnerships. And then we want to invest in those companies and new businesses through community rounds, angel syndicates, and venture capital. We've got some big goals over the next 10 years, we want to help create 1,000 jobs, we want to support 1,000 women owned businesses, we want to educate 10,000 new angel investors, and we want to source $100 million in capital for black-owned businesses and startups.

And to do that we built a portfolio of different revenue streams to create value for our community. And those revenue streams involve management consulting, selling merch through our marketplace, developing a media and marketing arm, and investing directly into companies through the private markets.

So, when it comes to management consulting, we're able to partner and collaborate with local startups that are homegrown, such as HX innovations and TheraV. HX innovations is also in the house, and we work with companies like those to help them get investment ready and set up on campaigns so that everyday people can invest in them as well. And shameless plug but they have campaign that’s live. You all should talk to Nicole from HX and reserve your reservation. We've also worked with startups that are across the country. So KiddieKredit is a company that's based in Miami, Florida. They teach kids how to build credit through doing chores. And that's a company that we found through our nonprofit, but now through our for-profit, we're able to connect them with venture capital firms. And we connected them with a VC firm based in Philadelphia, that VC ended up writing a $100,000 check. And Bison Venture Partners is receiving carried interest in that deal. So that's how we monetized how we actually create access and equity for early stage underrepresented founders.

We also invest in early-stage companies ourselves. It's 2022, and it has never been easier to invest the private markets. So through platforms like Wefunder, Republic, and StartEngine, everyday people, everyone in this room, whether you're accredited or not accredited, you can invest in a local small business or technology startup and get on their capitalization table. We invest directly into the community rounds that we find on these platform, and then we also get our community of founders to raise on those platforms as well. We also leverage platforms such as KingsCrowd, which is basically the Bloomberg of the private markets. So we're actually able to educate our community on what it means to build a diversified portfolio of early stage startups and small businesses and they're actually making educated bets on these early-stage startups. And the beauty is that we're creating access that has never been seen before in the private markets.

All of this falls under our umbrella of educating our community of both entrepreneurs and investors, because investing in the private markets or raising a community round is relatively new, it's less than 10 years old. So we have to create a lot of content to educate our community and make sure that people understand what it means to be an investor and to raise from your community. So through our brands, our IP, such as VC•ish (Merch Available), The Ghetto VC (Pre-Order Available), we're able to create content that engages our community, and galvanizes them to invest in one another.

We’re also building our own marketplace. We're building a market called HBCU.market, it (aims to be) the largest ecommerce platform supporting CPG brands that are founded by students and alumni from Historically Black Colleges and Universities. We see this as a billion dollar opportunity, and we're absolutely going to take advantage of that. We also sell our own merchandise, whether it's coffee, or hoodies, or shirts. All of this is revenue that goes back to helping us do the work of supporting other entrepreneurs and educating our community of investors.

So you might be asking, well, how does Bison Venture Partners make money? How does an investor in Bison Venture Partners get a return? This is how: Angel Investors like you all visit our website wefunder.com/bisonvp where you can invest for as little as $100. Bison Venture Partners then executes on our business model, which revolves around consulting startups, selling merchandise through our marketplace, developing media and marketing content, and then also investing in companies through the private markets. We're then able to generate a return and pay back our investors.

Like I said, we're currently fundraising, we've raised over 170 investors, many of whom are in the room today, I'm grateful for you, and we've got room for more. We want to raise $250,000 over the course of the fall. Its a minimum of just $100 to invest in an early stage startup and we plan on making a really big impact and disrupting the trillion dollar blind spot. I want to say thank you, and visit our website wefunder.com/bisonvp to invest today. Thank you very much!”