My angel investment just paid dividends!

Learn how my small investment in Gumroad is performing so far...

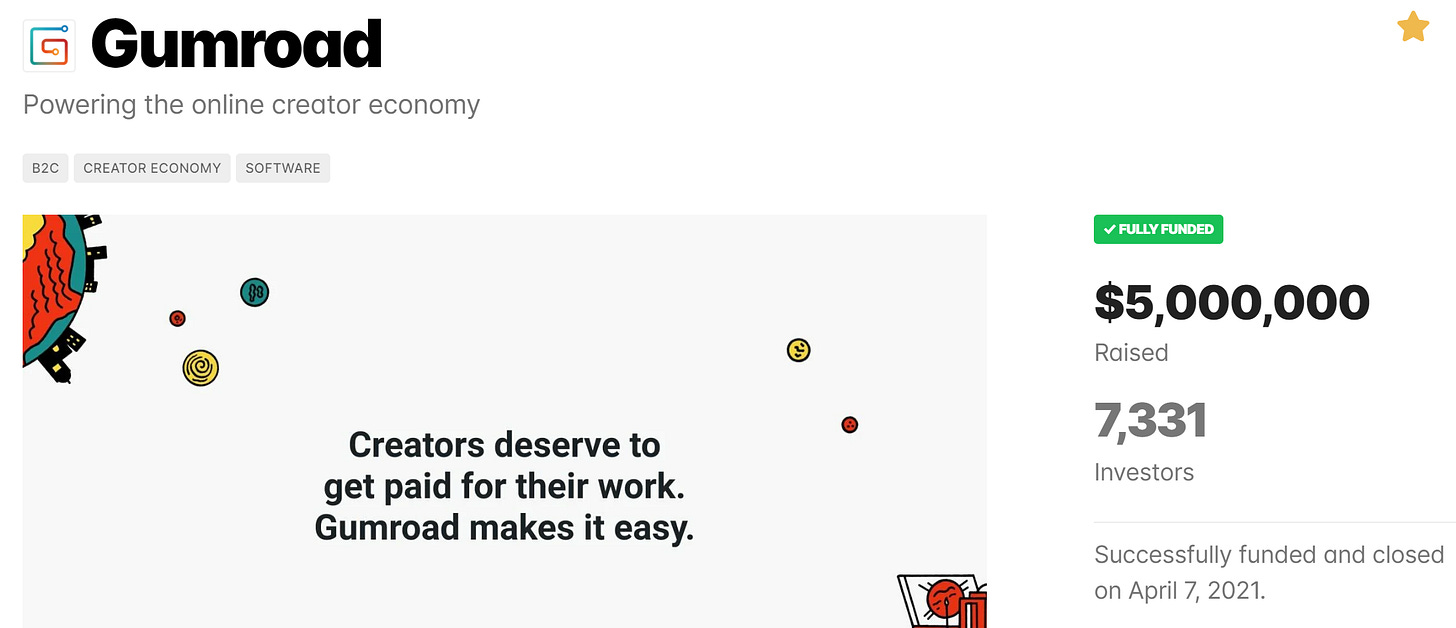

A Summary of Gumroad's Crowdfunding Campaign

In 2021, Gumroad, a thriving platform that streamlines online commerce for creators, successfully raised $5 million through crowdfunding. The campaign, which involved 7,331 investors, closed on April 7, 2021, under a SAFE agreement at a $100 million valuation cap.

About the Company

From its launch in 2011 until the campaign in 2021, Gumroad had empowered creators to sell products worth over $390 million. In the pivotal year of 2020, the platform processed $143.8 million in sales, a testament to its growing influence. The net revenue in that year was $9.2 million, marking an 87% increase from 2019, and net profit stood at $1.08 million, a staggering 286% growth from the previous year.

Problem Identified & Solution Developed

Gumroad arose from the identified need to simplify the online selling process for creators, providing a streamlined platform to manage sales and customer relationships with ease. The company facilitated the swift setup of online businesses, handling essential aspects such as payment processing and customer communication for a reasonable fee of 3.5% to 8.5% of sales.

Product Overview

The platform stood as a nurturing ground for creators, offering them tools to sell both digital and physical products effectively. The platform also assisted in building email lists and running membership businesses, coupled with analytics to help creators enhance their strategies.

Traction & Growth Metrics

By 2020, Gumroad had exhibited remarkable traction, with the creators on its platform having increased their gross merchandise volume by 94%. The year was marked with substantial growth in revenue and gross profit, elevating by 87% and 105% respectively.

Serving the Creator Economy

The platform catered to a diverse clientele, including writers, musicians, and personal trainers, offering a conducive environment for selling a variety of products online. It established itself as a versatile solution for creators from different fields.

Business Model

Gumroad had a creator-centric business model, generating revenue through a fee on the gross merchandise volume, a premium SaaS offering, and a discovery fee on referred sales. This approach ensured that Gumroad's success was aligned with the success of the creators on its platform.

Market Landscape and Competition

During a time when the creator economy was burgeoning, Gumroad envisioned becoming the default platform for creators. Even amidst stiff competition from venture-capital backed platforms, Gumroad differentiated itself by fostering a community of creator-owners.

Vision and Strategy

With the proceeds from the 2021 crowdfunding round, Gumroad embarked on a journey to expand its team and introduce features that would assist creators in scaling their businesses. It also initiated an expansion into the physical products and membership domains, enriching its offering suite to meet the evolving needs of creators.

Funding Trajectory & Co-Investors

By 2021, Gumroad had attracted $8.1 million in funding since its inception in 2011, with backing from renowned investors like Kleiner Perkins and Naval Ravikant. The crowdfunding campaign marked a significant milestone, laying a robust foundation for the company's future trajectories.

After making my $500 investment, I started adding value as an investor…

I used the Gumroad platform to sell pre-orders of my publication, The Ghetto VC, and we subsequently used it to sell seats in our first Intro To Angel Investing course. I do this because I’m passionate about educating others on how to start investing as a community and learning as a collective. I never teach things that I don’t have direct experience with.

Here’s where things got interesting. One day, I check Twitter, and see this from the founder…

Shortly afterwards, this email hit my inbox…

Today, those dividends hit my bank account!

Is $5.01 a lot of money, of course not… but it is income that’s been passively generated from my investment in a privately-held business. As the startup continues to grow, I anticipate receiving future dividends, in addition to seeing the exponential growth of my initial $500 investment. As we always discuss, startup investing is a long-term game.

If you’re interested in learning how to get started, and joining a community of other early-stage investors, we’ve got room for you!

Be sure to create a free account in our community platform, and enroll in our online course if you’re ready to take the leap as a first-time angel. I look forward to seeing you there!